Dealmaking Platform

Summary

When I joined Finalis, the platform had grown on top of legacy systems, resulting in complex navigation, generic workflows, scattered data, and limited visibility for both customers and internal teams.

Our team was responsible for improving and later replatforming the compliance experience used by bankers and back-office analysts. Through a mix of UX redesign and operational alignment, we turned a confusing, multi-layered process into a clearer, simpler, and more predictable experience.

Incremental improvements during 2023 raised annual CSAT from 72% to 86%, and in 2024, the launch of the simplified homepage further increased satisfaction to 93% while reducing support requests related to submission status.

-> Explore an AI-enabled prototype

Made for early internal validation with the Delivery team.

Problem Framing

→ Workflows were generic and identical across all transaction types, which encouraged incorrect usage of the available tools and created unnecessary friction.

→ Navigation had too many layers, making it difficult for users to find reports or understand the current status of their transactions.

→ Customers lacked context about the documentation required to operate and close their deals. This slowed down the process, increased dependency on support, and made it harder for them to manage their pipelines effectively.

→ The compliance team struggled to meet SLAs due to limited access to complete reports, reliable data, and proper traceability.

→ Data was fragmented across multiple services, complicating audits and creating inconsistencies across internal processes.

What Users Needed

Customers (bankers and advisors): better visibility, fewer clicks, and proactive guidance rather than having to hunt for tasks.

Compliance analysts: reliable, up-to-date data, contextual information for decision-making, and powerful filters to assign and prioritize work.

The organization: a scalable system aligned with FINRA/SEC rules, with a single source of truth for audits that could eventually serve as a white-label product for other broker-dealers or boutique banks.

The Process

This project started without a clear long-term strategy, but with a pressing need to improve workflows to ensure compliance and operate more efficiently. We started by creating a quick prototype that covered the core areas of the service. It helped us validate expectations early, gather user feedback, and align with engineering from the start.

Given tight timelines, we first identified the most critical pain points in the current interface. We worked closely with the Customer Success team to understand daily frustrations, and then focused our research on those specific issues. A new design system also allowed us to bring consistency and move faster.

As the project evolved, a new Head of Design joined and provided strategic direction, including hiring a service designer who played a key role in uncovering deeper operational pain points.

Our Approach

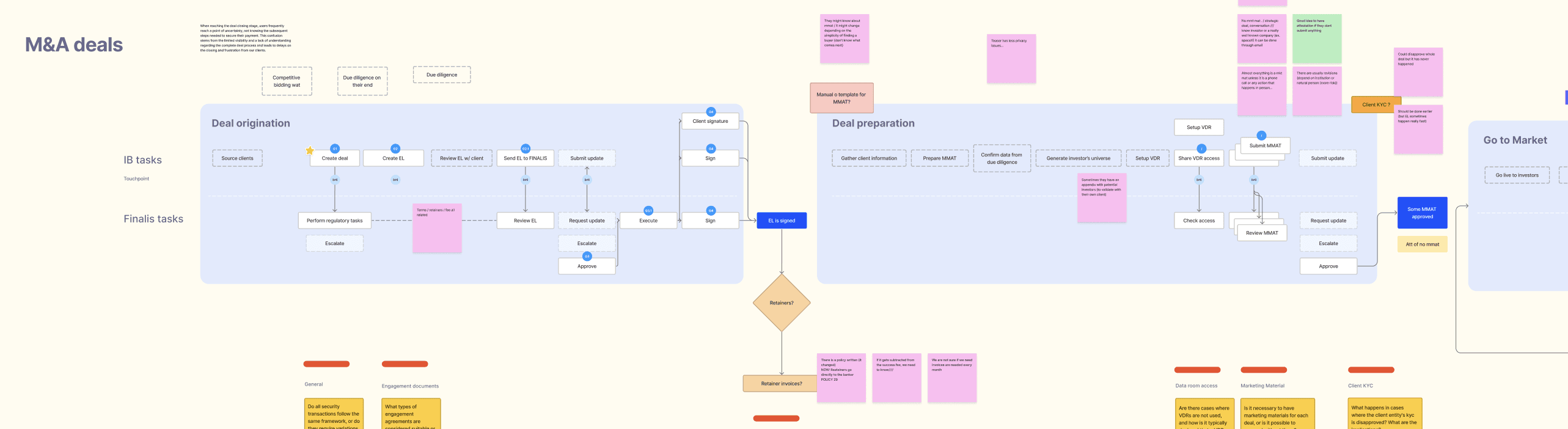

We conducted in-depth process reviews with the service designer, shadowing internal teams and mapping the end-to-end compliance and back-office workflows. This helped us spot friction points, gaps in documentation requirements, and inconsistencies in how information was updated across systems. In parallel, we ran focused interviews to dive deeper into the key pain points and to understand the deal lifecycle from the end-user perspective, which we later compared against the operational steps to reveal misalignments and gaps.

We also found that the overall complexity of the process had translated into a cluttered UI: too many layers of information, limited visibility into what comes next, and too many clicks to understand the status of a report. There was no sense of progression within workflows. Our users came from different backgrounds, ages, industries and levels of technical comfort, so we prioritized clarity and accessibility over visual complexity. The goal was to make the platform intuitive for everyone, whether they were seasoned analysts or bankers who only logged in occasionally. This principle guided both interaction design and the overall visual language.

In this immersion, we identified critical moments where responsiveness needed to be improved. Qualitative interviews also revealed a mismatch between user expectations of turnaround times and the organization’s internal SLAs. This communication gap shaped how we prioritized the roadmap.

The Outcomes

The Redesign We Brought to Life

During 2023, incremental improvements increased annual CSAT from 75% to 86%. In 2024, we launched several key enhancements:

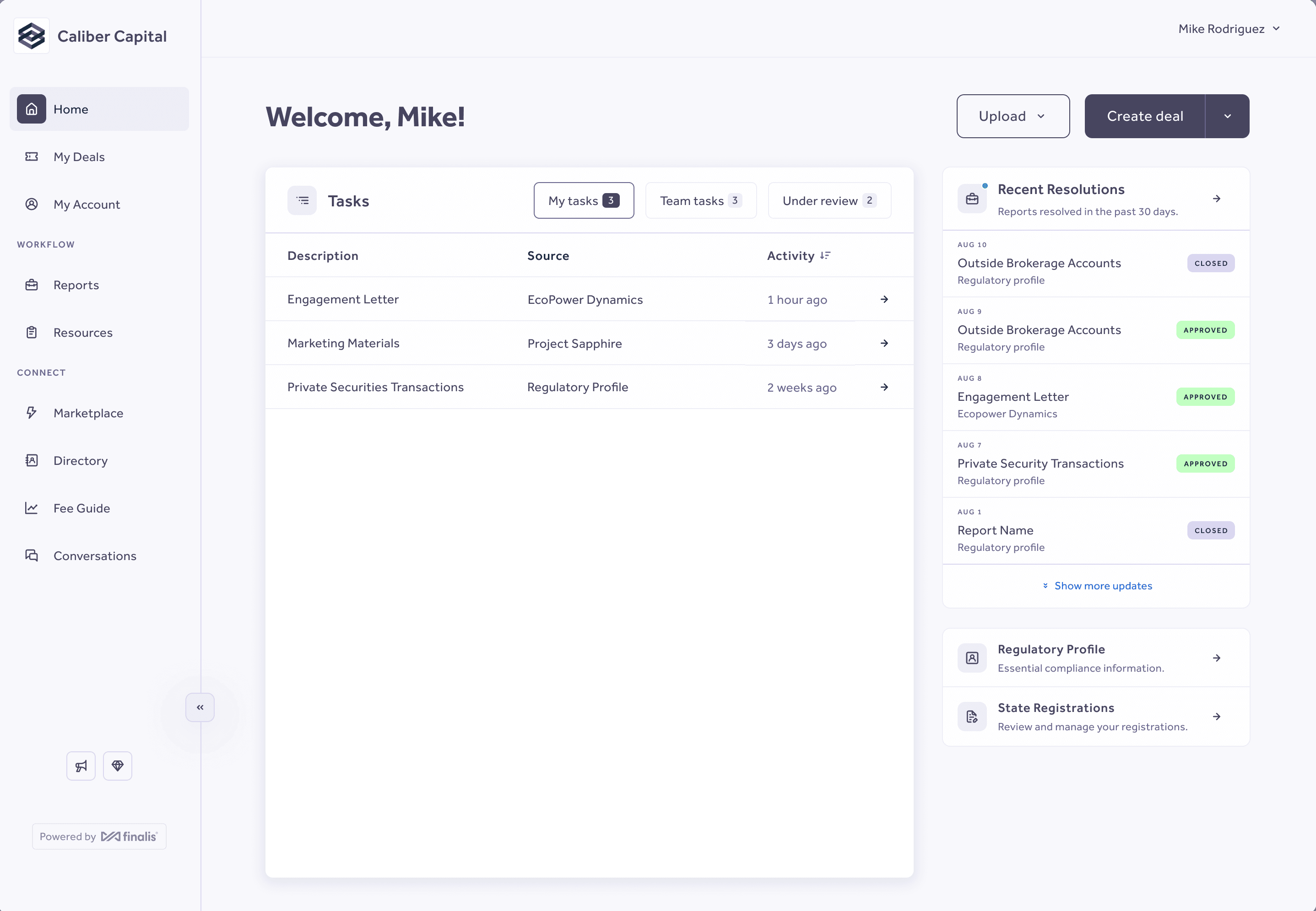

A Unified Homepage

Even though our focus was on redesigning workflows, the number of processes made it clear that users needed a centralized view. The new homepage surfaces the most important information at a glance: report status, pending actions, and recent resolutions. This allowed users to understand priorities without navigating through multiple sections.

The updated screen delivered a much simpler visual design and significantly improved user satisfaction. After its release in Q2 2024, satisfaction scores in relation to the Homepage increased by 31% and support requests related to submission status decreased.

Redesigned Workflows

We restructured the end-to-end workflows to make requirements, next steps, and status updates clearer and more contextual. This reduced cognitive load, improved clarity, and aligned the experience with regulatory expectations. We also introduced task rules and inactivity triggers to keep data more complete and up to date.

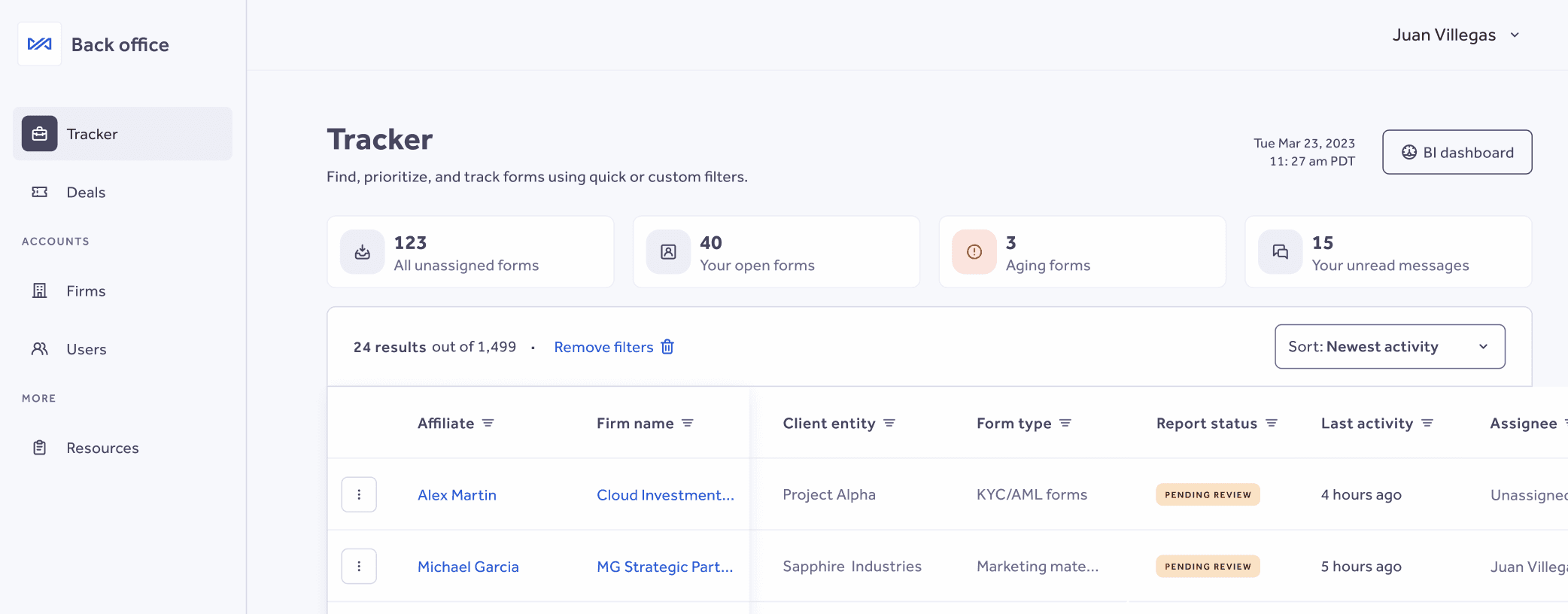

Back-Office Tracker and Operational Tools

For internal teams, we built a tracker that consolidated all reports with relevant details and custom filtering tailored to their daily work. This allowed analysts to prioritize, respond faster, and maintain consistency across reviews.

At launch, we also included a feedback form to gather insights from daily use, along with a training session designed to help the team onboard smoothly and observe their first reactions.

A New Chapter

Replatforming Toward a Unified System

We’re now entering a new phase: migrating the compliance platform to Atlas, a centralized system that unifies all data and eliminates fragmentation.

The previous redesign improved clarity and usability, but the platform was still spread across multiple services. This led to scattered data, inconsistencies and challenges during audits, making a unified database essential.

Atlas'd bring all compliance, firm, user and deal information into a single source, enabling:

Reliable and consistent data for internal teams

Clear audit trails

Full synchronization across modules

More automation and fewer manual steps

Easier maintenance and long-term scalability

This phase also aims to introduce new technologies like AI, APIs and automation tools. On the design side, I incorporated AI-driven tools to quickly create higher-fidelity prototypes and validate ideas earlier, which was key when refining complex workflows like the Compliance Tracker.

Each rebuild taught us something important:

The first replatform focused on UX clarity and reducing complexity. It gave users structure, visibility, and simplicity.

The current replatform focuses on data integrity, automation, and operational scalability, building on the experience and usability improvements from the previous version.

This new phase brings together the best of both worlds: a reliable, unified backend supported by a mature, proven UX layer.